Overview

There is a cacophony of events coming to fruition which reversed the downward trend in oil. First, Brent crude futures turned positive and U.S. oil extended gains Thursday after news OPEC had agreed to keep oil output unchanged for the second half of the year at 30 million barrels per day, according to Reuters. Now, we all know no one abides by these quotas, but it makes for a good headline.

(click to enlarge)

Chart provided by Yahoo.com

Second, The European Union is preparing to impose an oil embargo on Iran on July 1, unless diplomatic talks over its disputed nuclear program see progress. Iran's oil minister on Thursday shrugged off the tightening international squeeze on his country's oil exports, declaring that Tehran was not feeling the pinch and warning that an energy-hungry world could not do without Iranian oil and natural gas. The looming EU oil sanctions against Iran will result in a higher cost for Europe, Iranian Oil Minister Rostam Qasemi warned on Thursday ahead of the OPEC cartel's latest output meeting in Vienna. "Of course we might face some problems, but for sure ... the European citizens will pay more costs," Qasemi told reporters in Vienna, when asked about the sanctions.

I see any conflict with Iran causing oil prices to rise. What's more, we have the Syrian situation which looks to be heating up fast. The Middle Eastern risk premium is no longer priced into oil based on a perceived calming of tensions with Israel. I posit it is the calm before the storm. Any disruption in Middle Eastern oil distribution underpins the value of these U.S. oil stocks.

Finally, the latest CPI and PPI numbers were on the deflationary side spurring rumors the Fed will announce a QE program at its next meeting. The pop by the Mexican Peso is a telling sign smart money is preparing for the news. Mexico's peso strengthened as falling U.S. consumer prices fueled speculation the Federal Reserve will act to spur growth in the economy of the Latin American country's biggest trading partner, according to Bloomberg. If the Fed implements some type of QE program, history shows oil companies will benefit.

Company Reviews

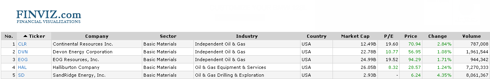

The following oil stocks are U. S. centric and rising on the recent OPEC headlines, amongst other news. I believe they present significant buying opportunities at these levels. The following is a brief review of each company's recent performance and fundamentals. Below is a table depicting summary information and Thursday's performance statistics for each company.

(click to enlarge)

Continental Resources Inc. (CLR)

(click to enlarge)

Continental is trading well below its consensus estimates and its 52 week high. The company is trading 28% below its 52 week high and 32% below the analysts' consensus mean target price of $92.24 for the company. Continental was trading Thursday for $69.94, up almost 2% for the day.

Fundamentally, Continental has several positives. The company has a forward PE of 15.19. Continental's strength comes from its growth in sales and EPS. Per Finviz.com, Continental has quarter over quarter sales and EPS growth rates of 1191% and 148% respectively. The company's ROE is approximately 30% as well as its net profit margin. That means one out of every three dollars goes to the bottom line. Not bad.

The Bakken is booming and Continental is leading the way in all respects. Continental looks primed to rally. The stock is a buy here.

Devon Energy Corporation (DVN)

(click to enlarge)

Devon is trading well below its consensus estimates and its 52 week high. The company is trading 33% below its 52 week high and 50% below the analysts' consensus mean target price of $84.80 for the company. Devon was trading Thursday for $56.36, basically flat for the day.

Fundamentally, Devon has several positives. The company has a forward PE of 8.68. Devon pays a dividend with a yield of 1.42%. Devon's expected EPS growth rate for next year is 31%. The company's profit margins are improving. The current net profit margin is 18.29%.

Devon is trading for 50% below its mean target price. The company was hit hard by the glut of natural gas on the market. The situation seems to be reversing as of this writing. Natural gas spiked 10% mid day Thursday. I believe Devon presents a buying opportunity at this level.

EOG Resources, Inc. (EOG)

(click to enlarge)

EOG is trading well below its consensus estimates and its 52 week high. The company is trading 22% below its 52 week high and 32% below the analysts' consensus mean target price of $123.69 for the company. EOG was trading Thursday for $93.51, up almost 1% for the day.

Fundamentally, EOG has several positives. The company has a forward PE of 14.86. EOG pays a dividend with a yield of 0.73%. EOG's expected EPS growth rate for next five years is 23%. The current net profit margin is 11.61%. EOG's strength comes from its growth in sales and EPS. EOG has quarter over quarter sales and EPS growth rates of 48% and 132% respectively. EOG's PEG ratio is .84.

EOG looks like it has been consolidating at this level for a few weeks. This is a strong, conservative, well-run company. I see this as a buying opportunity.

Halliburton Company (HAL)

(click to enlarge)

Halliburton is trading well below its consensus estimates and its 52 week high. The company is trading 22% below its 52 week high and 32% below the analysts' consensus mean target price of $123.69 for the company. Halliburton was trading Thursday for $93.51, up almost 1% for the day.

Fundamentally, Halliburton has some positives. The company has a forward PE of 7.57. Halliburton pays a dividend with a yield of 1.28%. Halliburton's expected EPS growth rate for next five years is 23%. The current net profit margin is 11.87%. Halliburton's strength comes from its growth in sales and EPS. Halliburton has quarter over quarter sales and EPS growth rates of 30% and 23% respectively. Halliburton's PEG ratio is .37.

Nevertheless, Halliburton has taken a shellacking recently after pre announcing North American profit margins this quarter will shrink more than previously forecast because of higher material costs. Avoid the stock until after earnings are announced in July. That should mark the low for the stock near term.

SandRidge Energy, Inc. (SD)

(click to enlarge)

SandRidge is trading well below its consensus estimates and its 52 week high. The company is trading 50% below its 52 week high and 63% below the analysts' consensus mean target price of $10.14 for the company. SandRidge was trading Thursday for $6.26, up almost 5% for the day.

Fundamentally, SandRidge has several positives. The company has a forward PE of 19.29. SandRidge's expected EPS growth rate for next year is nearly 100%. The current net profit margin is 16.75%. SandRidge has strong quarter over quarter sales and EPS growth rates of 22% and 27% respectively. SandRidge trades for less than two times book value.

SandRidge recently saw a cluster of insider buys over the past few months. Even so, the stock is way down, trading at the lower end of its five year trading range. SandRidge is down in sympathy with Chesapeake Energy (CHK). The CEO Tom Ward came from Chesapeake. I have no concerns regarding this matter and fell the stock has been unfairly punished. SandRidge is a buy at this level.

Conclusion

These energy markets are notoriously volatile. The only constant is the fact that energy prices have continuously risen over the years. If you have a long term time horizon, the stocks present substantial buying opportunities. Although, I would avoid Halliburton until after earning are announced in July. You may have an opportunity to pick up shares at a discount to today's price.

Use this information as a starting point for your own due diligence and research methods before determining whether or not to buy or sell a security. If you choose to start a position in any stock, I suggest layering in a quarter at a time on a weekly basis at a minimum to reduce risk and setting a 5% trailing stop loss order to minimize losses even further.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in DVN, CLR, SD, EOG over the next 72 hours.

sam houston state university bradley manning whoopi goldberg tebowing tebowing washington wizards rudy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.